In light of the recent capital and energy market volatility due to the near-term impact of the Coronavirus on hydrocarbon demand and resulting short-term oversupply of crude oil, Meridian has received questions as to what this all means for the long-term prospects of our Company. Thus, we highlight below: (a) the performance of the refining industry through the latest previous downturns; (b) impact on the broader refining industry and Meridian’s existing competitive advantages and positioning; and, (c) the strong demand response that occurs coming out of periods of low market prices.

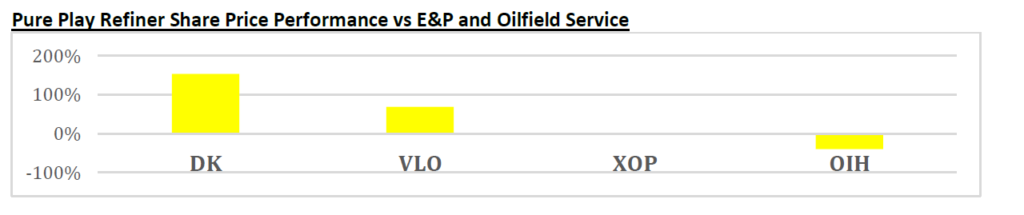

Regarding performance and value creation, our expectation is for the refining industry to be the best performing asset class intermediate and longer-term within the energy value chain. Oil prices bottomed at $26.21 bbl in February 2016. The equity share prices for Delek and Valero – which are the pure play refiners – over the next four years increased by 154% and 69% respectively. In contrast, the XOP (Energy Exploration & Production ETF) declined 1% and OIH (Oilfield Service ETF) fell by 40% during the period.

Meridian’s Davis Refinery is not scheduled to come online until the second half of 2023 and Meridian is not impacted by the shorter-term issues affecting the energy and financial markets. In fact, these negative events strengthen the Meridian investment case intermediate and longer-term as:

- Cash flow for the integrated oil companies will decline significantly over the next two years, thereby accelerating underinvestment in refining, which in turn increases the already high operational risk on an aging infrastructure. The current refinery network around Meridian’s Davis Refinery was already challenged and now there is real risk that older refineries in the region will be impaired or shut down.

- Meridian is uniquely positioned to capitalize on these accelerating industry structural disadvantages. The Davis refinery will:

- (a) have the highest light product yield in the industry;

- (b) have access to the most advantaged product markets; while

- (c) processing light sweet low sulfur shale crude at a discount with low operating costs;

- (d) running at reliable high utilization rate; and,

- (e) being fully environmentally compliant with a fraction of the emissions footprint relative to the industry.

- Long-term refined product demand trends for diesel and gasoline remain strong, are expected to strengthen in a downturn and subsequent recovery while risks to security of product supply increase. Historically, demand shocks have led to significant and sustainable demand strength.

Leave A Comment